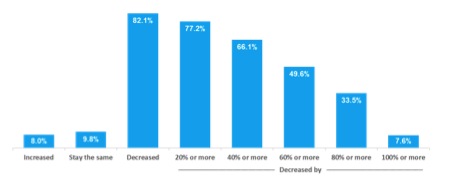

The COVID-19 pandemic has caused an economic crisis that is unprecedented in scale and nature. According to a new research program initiated by NAPCO Research (NAPCO Media is the parent company of Promo Marketing), a large majority of promotional products companies surveyed report that sales are trending downward, with sales falling an average of 42.8 percent over a 30-day period (from mid-April through mid-May) (Figure 1).

The research also indicates that the bottom of the economic downturn is not yet in sight. Still, many promotional products businesses report taking aggressive action to protect themselves and their employees from the effects of the current recession.

Figure 1: Sales Change Last 30 Days

To help promotional products companies navigate the crisis to the recovery on the other side, NAPCO Research has launched the COVID-19 Promotional Products Business Indicators Research. This research initiative takes the pulse of the industry by surveying a cross-section of promotional products companies, including promotional products distributors, suppliers/manufacturers, apparel decorators, commercial printers, and more. Click here to download the first full report.

Index Reports Business Activity Falling

The research tracks current and leading business indicators. For the current period, the index of current business indicators (including sales, employment, prices, and pre-tax profitability) for the promotional products industry closed at 33.1. A reading below 50.0 means more businesses report activity is falling than report activity is rising. This index measures the breadth of the contraction and determines when it has hit bottom.

The index of leading business indicators (including estimate activity, new orders, and confidence) closed at 35.2. A reading below 50.0 means more businesses report these forward-looking measures of activity are falling than report they are rising. This measure is used to identify the first signs of recovery and how recovery is likely to progress. With both indexes in the mid-30s, the numbers suggest that the promotional products industry is not yet at the bottom of the downturn.

Companies are taking action to protect themselves and their employees. Many of the companies surveyed have adjusted course aggressively to weather the economic crisis. Actions include following CDC guidelines for sanitization and social distancing, pivoting to producing or distributing healthcare products, adjusting marketing efforts, and applying for loans through federal programs. One bright spot is the adaptability and confidence seen among participating companies. Most companies surveyed are not taking this situation lying down, and are instead making adjustments to survive the current recession.

One survey participant writes, “We’ve had to reposition our business and repurpose our existing machinery. Instead of selling awards for events we are selling signs and graphics for retailers.”

“We are going to offer several levels of incentives to new businesses establishing an account,” writes another participant.

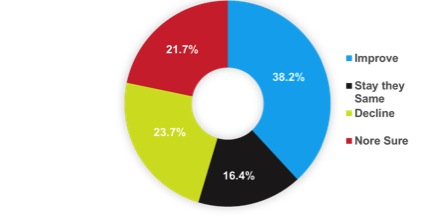

Confidence is high in the industry. When asked to predict business conditions over the next month, respondents report surprisingly high levels of confidence—38.2 percent of participants expect business to improve during the month ahead, while 40.1 percent expect business to stay the same (16.4 percent) or decline further (23.7 percent). More than one-fifth report business is so inconsistent they don’t know what to expect (Figure 2). The high confidence level among companies surveyed runs contradictory to the business indicators numbers, but reveals a spirit resilience and determination in the promotional products industry.

Figure 2: Business Expectations Over the Next Month

When Will the Economy Bounce Back?

A key question on many businesses’ minds is when will the economy bounce back given recent forecasts. According to The Wall Street Journal Economic Forecasting Survey, economists and analysts believe that second quarter GDP will reflect the worst of COVID-19 effects, with GDP declining at a 25.3 percent annual rate, followed by upticks in the third and fourth quarters of 6.2 percent and 6.6 percent respectively.

While this drop may seem steep, David Wilaj, an economist at the Printing United Industry Alliance’s Center for Print Economics and Management, believes there is potential for a quick recovery. He says, “Although many Americans are familiar with the length of the Great Recession, it is important to note that not all recessions are the same. When many large financial institutions failed in 2008, firms were forced to close their doors for good and many jobs were lost. Now, many businesses were forced to close and furlough workers, but a majority of these jobs will be available again once virus concerns are eased.”

Download the full report here.

About NAPCO Research

NAPCO Research develops research and economic models that solve customer business problems. Market research is valuable for making strategic business decisions, solving challenges, and pursuing opportunities, and the NAPCO Media research team surveys, analyzes, and monitors critical trends related to marketing, printing, packaging, non-profit organizations, promotional products, and retailing. To learn more about how the team can leverage its research and industry subject matter experts to support your organization’s needs, contact Nathan Safran, vice president of research for NAPCO Mediea, at [email protected].